Background

This knowledge base contains general information about the Customate Api.

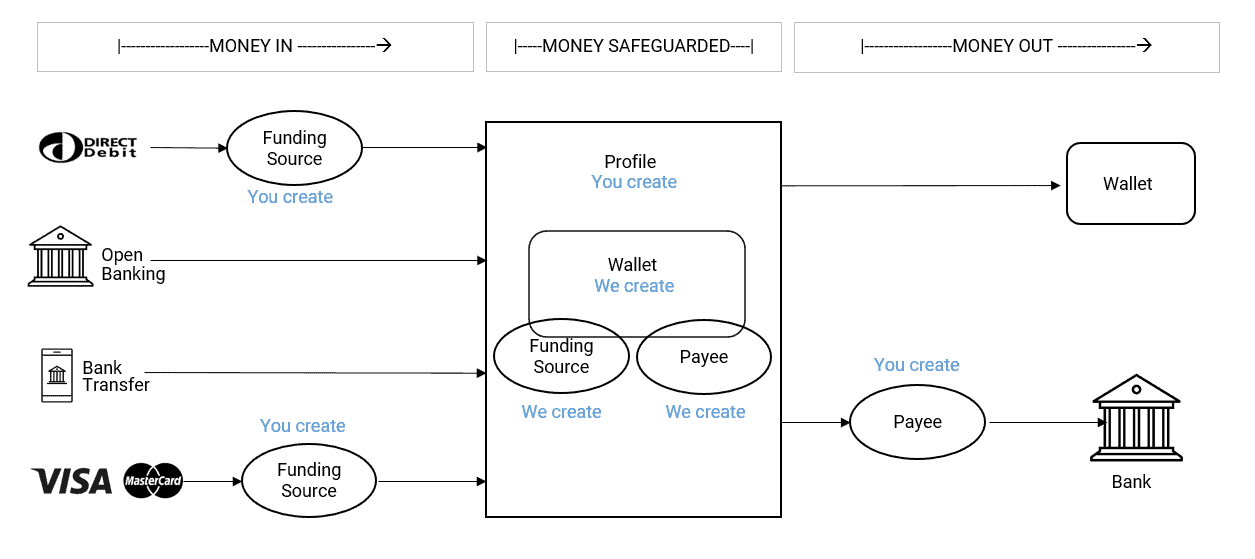

Customate offers virtual bank accounts in multiple currencies, supports bank transfers in and out, open banking in, digital direct debits, real-time customer onboarding, provides unique customer wallets, digital escrow wallets with funds safeguarded in ring fenced accounts under eMoney regulations.

How does the platform work

- We will require you to create a profile – see here for more information

- We will verify that profile after you have provided information – see here for more information

- We will assign a wallet to this profile. This wallet will contain a unique Euro and GBP bank account. You will be able to see the details of that wallet – see here for more information

- You may assign funding sources to enable payments into this wallet via GBP direct debit or scheme cards (Visa / Mastercard) to be made into the wallet – see here for more information

- Payments can be made into the wallet via open banking, bank transfers and, if a funding source is assigned, by GBP direct debit and scheme card. Schedules can be established to create recurring pulls of funds into a wallet – see here for more information

- Funds in the wallet are protected under eMoney regulations

- You may assign payees to enable payments out of this wallet via bank transfer – see here for more information

- You may pay funds out of the wallet to another wallet, or if you have created an external payee, to an external bank – see here for more information

Demo User interface

Customate offers a web based user interface accessed at https://gocustomate.com. This is for Demo purposes only and allows you to see a live profile via a user interface.

API

Customate provides an Api as a way for customers to automate and manage the flow of the money by creating profiles, schedules and making payments with different sources. This Api is compliant to all REST standards: has resource-oriented URLs, returns JSON-encoded responses, uses standard HTTP response codes and verbs, authentication, and communicates through secure HTTPS connections.

- Each Api client should receive a key and a secret from us, that will be used during an authentication process.

- Api endpoints details (expected request format, response examples) are described here.