Why do we verify profiles?

According to the requirements of the regulators (UK Electronic Money Regulations 2011, European Union (Payment Service) Regulations 2018), we are obliged to verify profiles before they can make payments.

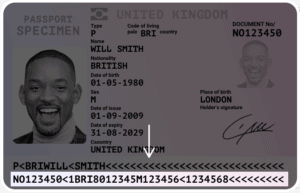

Some of the data required for verification is stored in the profile (name, date of birth, title, gender, address).

Verification requires providing the country of birth and mother’s maiden name amongst other items we may require.

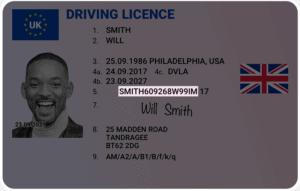

Other details are optional (e.g. passport, driving licence), but the more data that is provided, the more likely verification will pass.

Some information is country specific to the person:

- Provide a UK driving licence for UK profiles,

- US driving license and social security number for US profiles.

- For Spain provide a tax ID number. For other countries, provide identity card data.

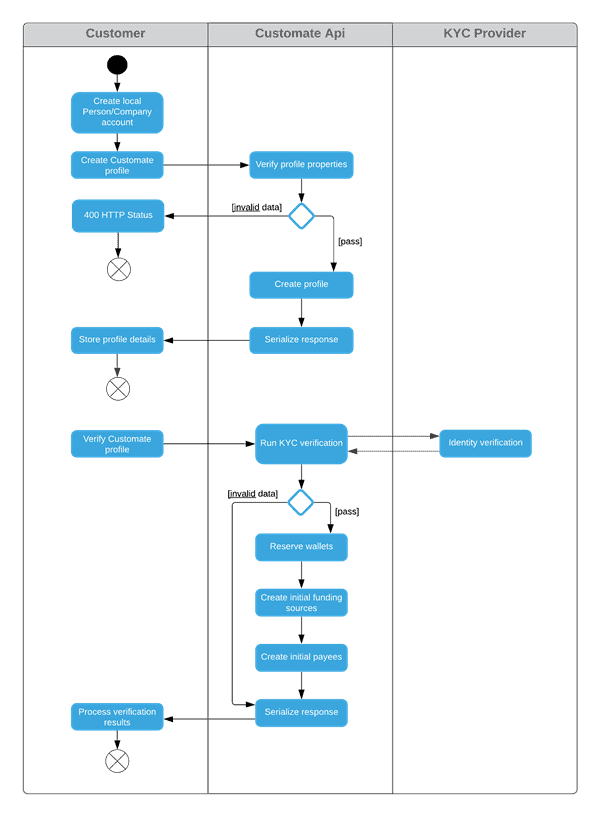

The verify profile endpoint checks the profile and returns the result. The result is one of pass, fail, more_details_required or not_verified.

When the profile is verified, Customate reserves wallets (GBP and EUR) and creates funding sources and payees linked to those wallets.

Do all profiles need to go through the KYC check to be verified?

Profiles need to be verified in order to have wallets assigned to them (GBP and EUR) and have funding sources and payees linked to those wallets, so they need to be verified.

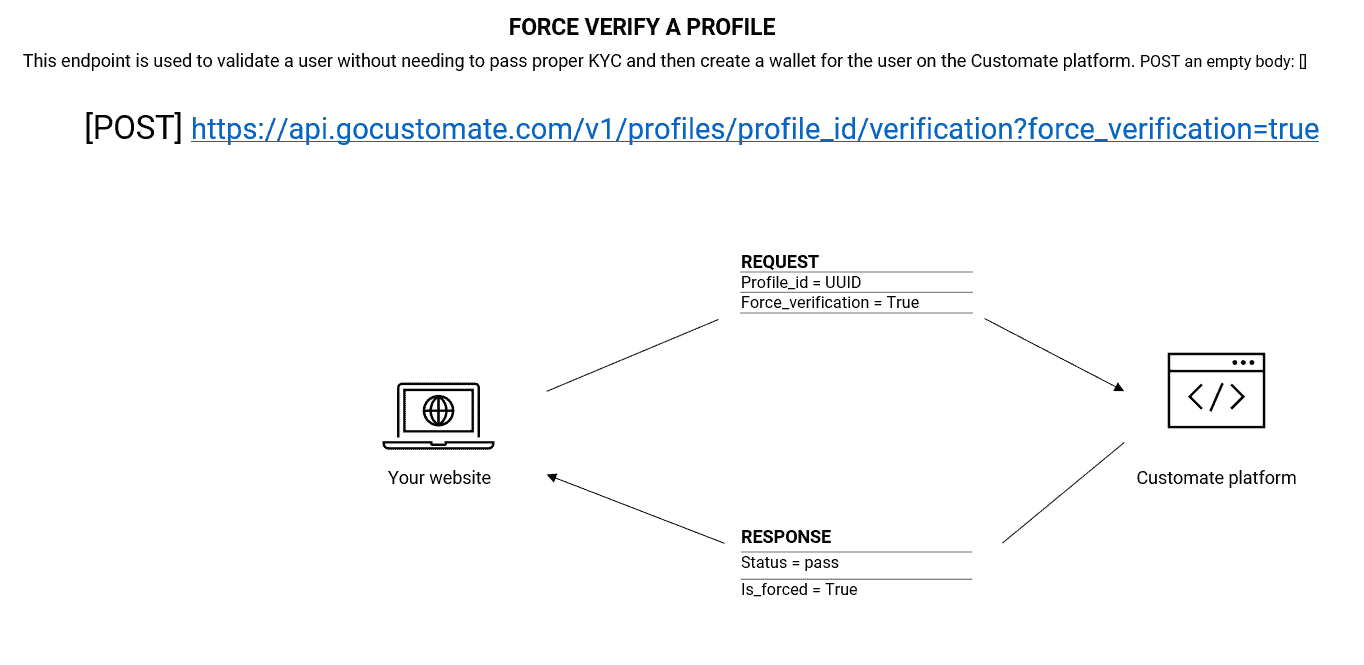

However if you have already verified a profile yourself, it can be force verified, i.e. no data is checked by the Customate platform and this essentially verifies the profile.

Process flow to verify a profile

Before processing a payment, a related profile should be verified. During verification, Customate will reserve wallets (for GBP and EUR) and create funding sources and payees:

Format of passport and driving licence numbers:

Endpoint to force verify a profile without KYC