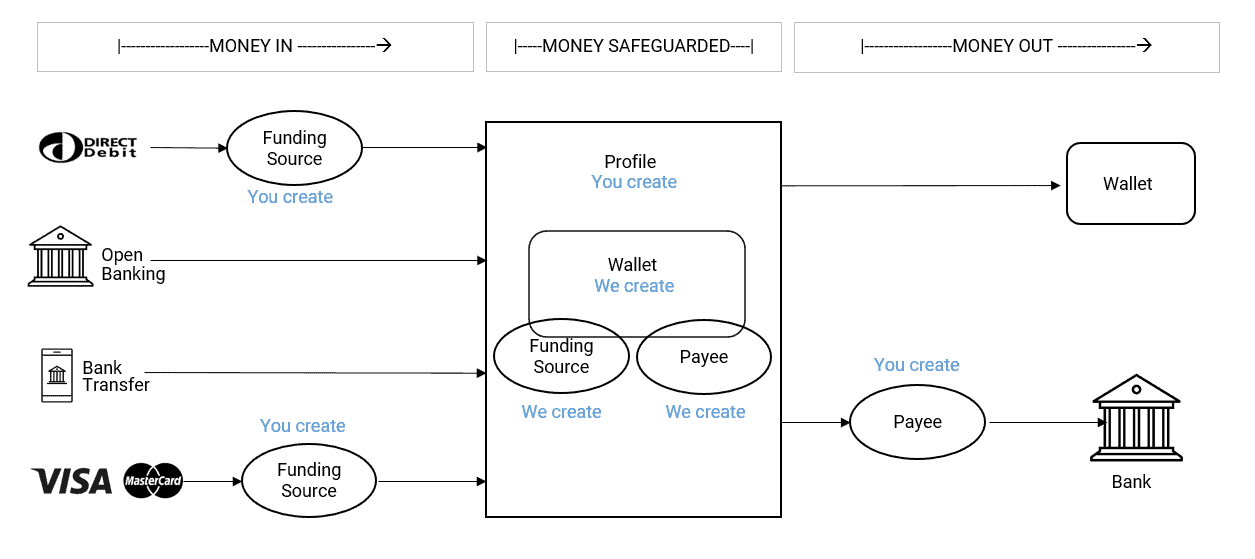

Entities that are created for an account

-

- We will require you to create a profile – see here for more information

- We will verify (or force verify) that profile after you have provided information – see here for more information

- We will assign a “wallet” to this profile. This wallet will contain a unique Euro and GBP bank account. You will be able to see the details of that wallet – see here for more information

- You may assign “funding sources” to enable payments into this wallet via GBP direct debit or scheme cards (Visa / Mastercard) to be made into the wallet – see here for more information

- Payments can be made into the wallet via 1) open banking, 2) bank transfers and if a funding source is assigned, by 3) GBP direct debit and 4) scheme card. Schedules can be established to create recurring pulls of funds into a wallet – see here for more information

- Funds in the wallet are protected under eMoney regulations

- You may assign “payees” to enable payments out of this wallet via bank transfer – see here for more information Schedules can be established to create recurring pulls of funds into a wallet – see here for more information

- You may pay funds out of the wallet to another wallet, or if you have created an external payee, to an external bank – see here for more information

This knowledge base provides a set of diagrams with a possible integration workflow that can be used by our clients in order to better understand who/when initiates Customate operations. First of all, it should be understood that before processing any incoming request, the Customate Api will run authentication & requests limit checks. These steps should be kept in mind for any Api calls (note that such verifications are skipped for most diagrams to not overload them with extra branches).