Embedded Payments. Payment Splitting & Scheduling. Dedicated Customer Wallets. Easy API Integration.

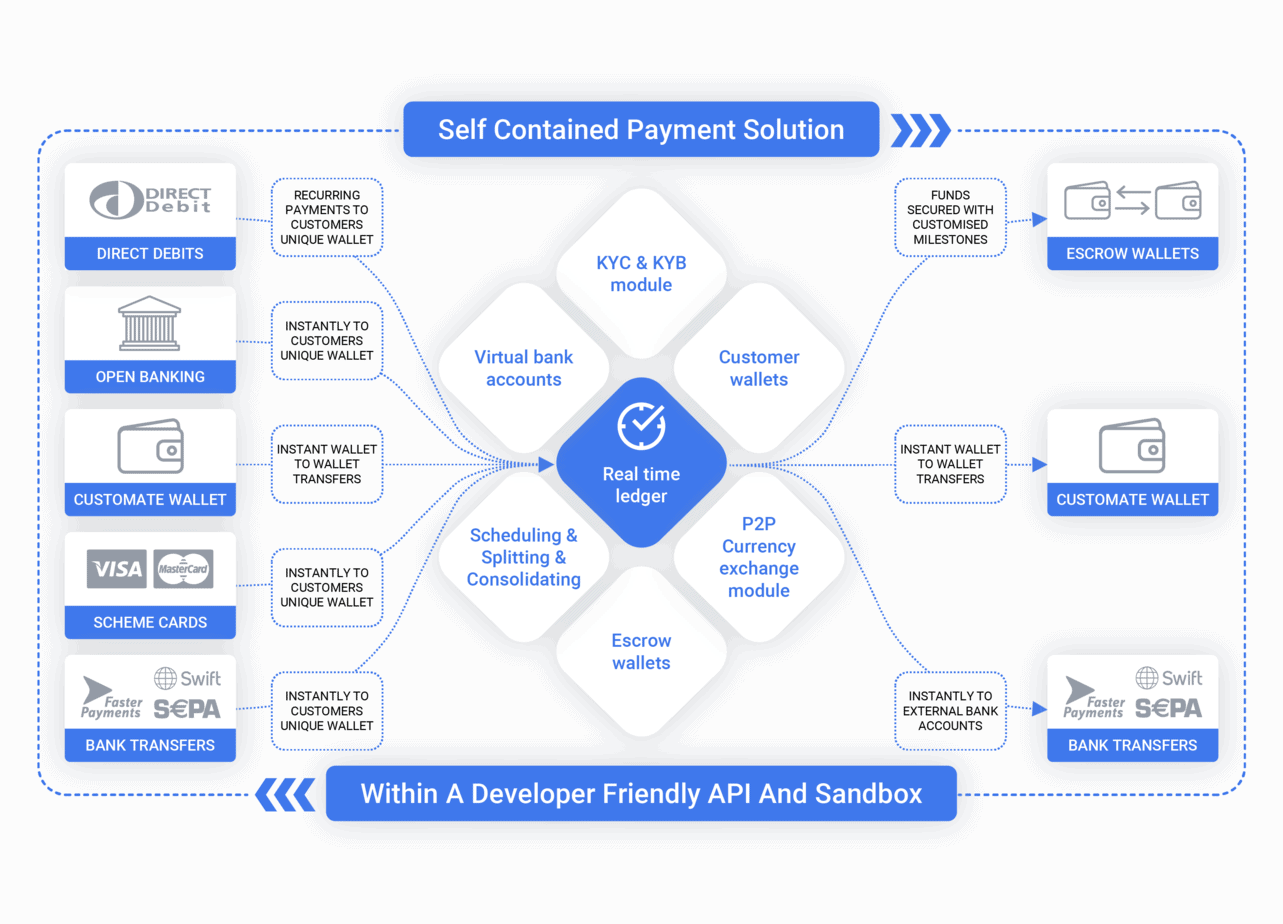

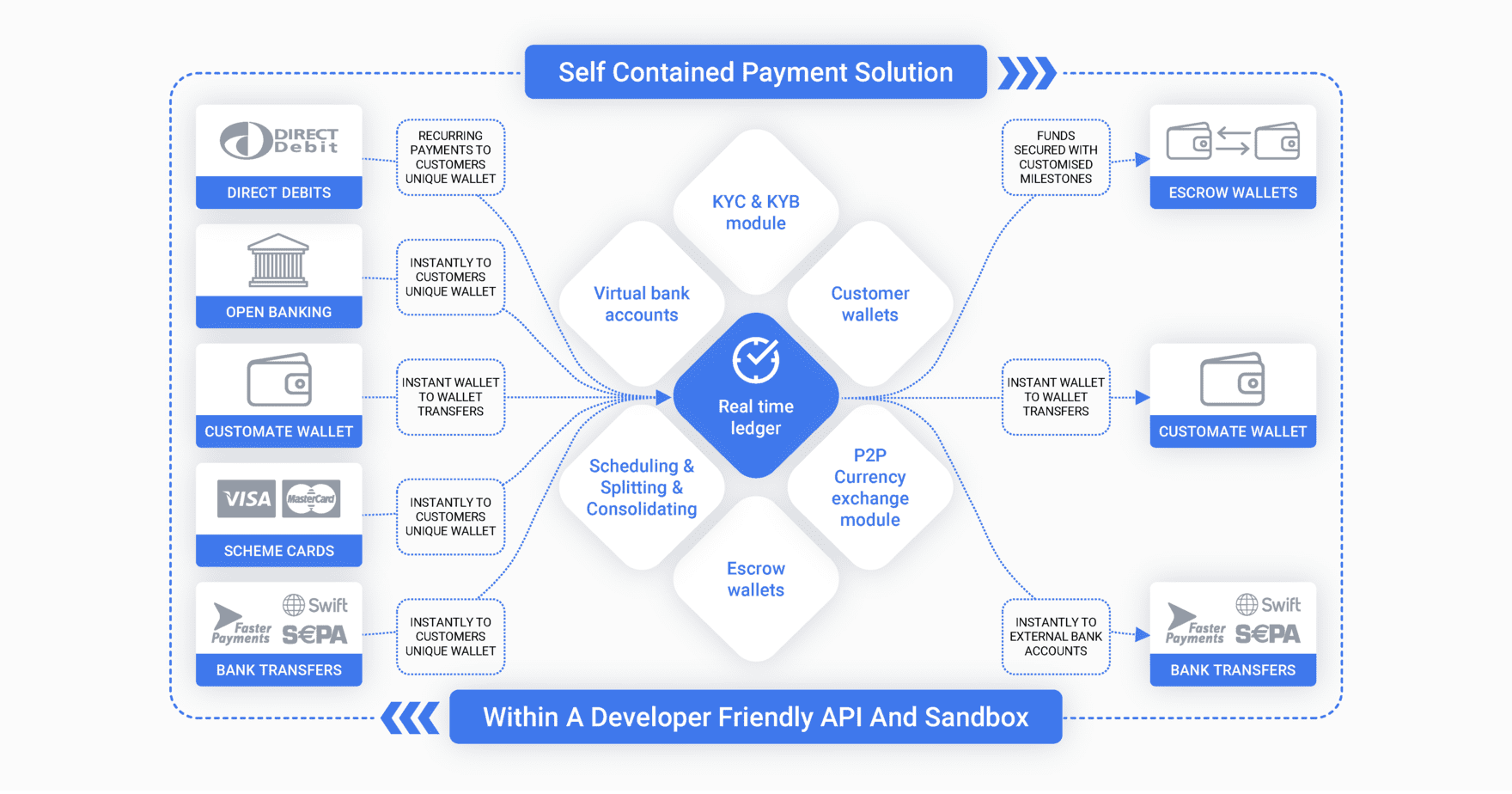

A developer friendly API driven, embedded payments platform, that safeguards all funds, creates dedicated customer wallets or digital escrow wallets instantly, verifies your customers, allows multiple options to pay and receive funds, enables you to create automated payment schedules and handles complex splitting and rules based payment scenarios.

Simplify and Protect your Payment Process

COMPETITIVE WHOLESALE FOREIGN EXCHANGE RATES

Convert funds within wallets at wholesale foreign exchange rates. Alternately exchange currencies between wallets at rates you choose.

SPLIT & AGGREGATE PAYMENTS

Establish flexible rules based logic to split incoming and outgoing payments in multiple directions to manage fees, commissions, sub agreements.

UNIQUE CUSTOMER WALLETS

Provide your customers with their own Digital Wallets which contain their own GBP, EURO and USD account that can be used just like any normal bank account.

ESCROW WALLETS

Create multiple digital escrow wallets to safeguard funds, pending achievement of your own customised milestones.

REAL TIME KYC

Use our API to verify your customers online to minimise onboarding challenges. Whitelist funding sources and payees to ensure integrity of your funds flow.

MULTIPLE PAYMENT OPTIONS

Fund your wallet via Direct Debit, Open banking, Card or bank transfer. Pay using SEPA, Faster Payments or Swift.

Benefits of the Customate Payments Platform

Build your own custom payment flow

We help you make your business payments faster, easier and safer. Integrate your existing platform into our API to streamline your payments and create a better customer experience. Create your own payment flow matching your business model thanks to our seamless payment solution. Our API product allows you to setup digital customer wallets enabling you to manage the escrowing and splitting of funds between users.

Feature rich API, Sandbox Account, and Developer documentation

Your business can access our payment services automatically via our API. Use our web-hooks to customise your customer reporting and analysis. Obtain a free sandbox account to test how easy you can integrate our API into your existing business processes. Sign up at our Developers page, where we provide clear documentation on our features and API functionality making it easy for your developers to integrate into our API.

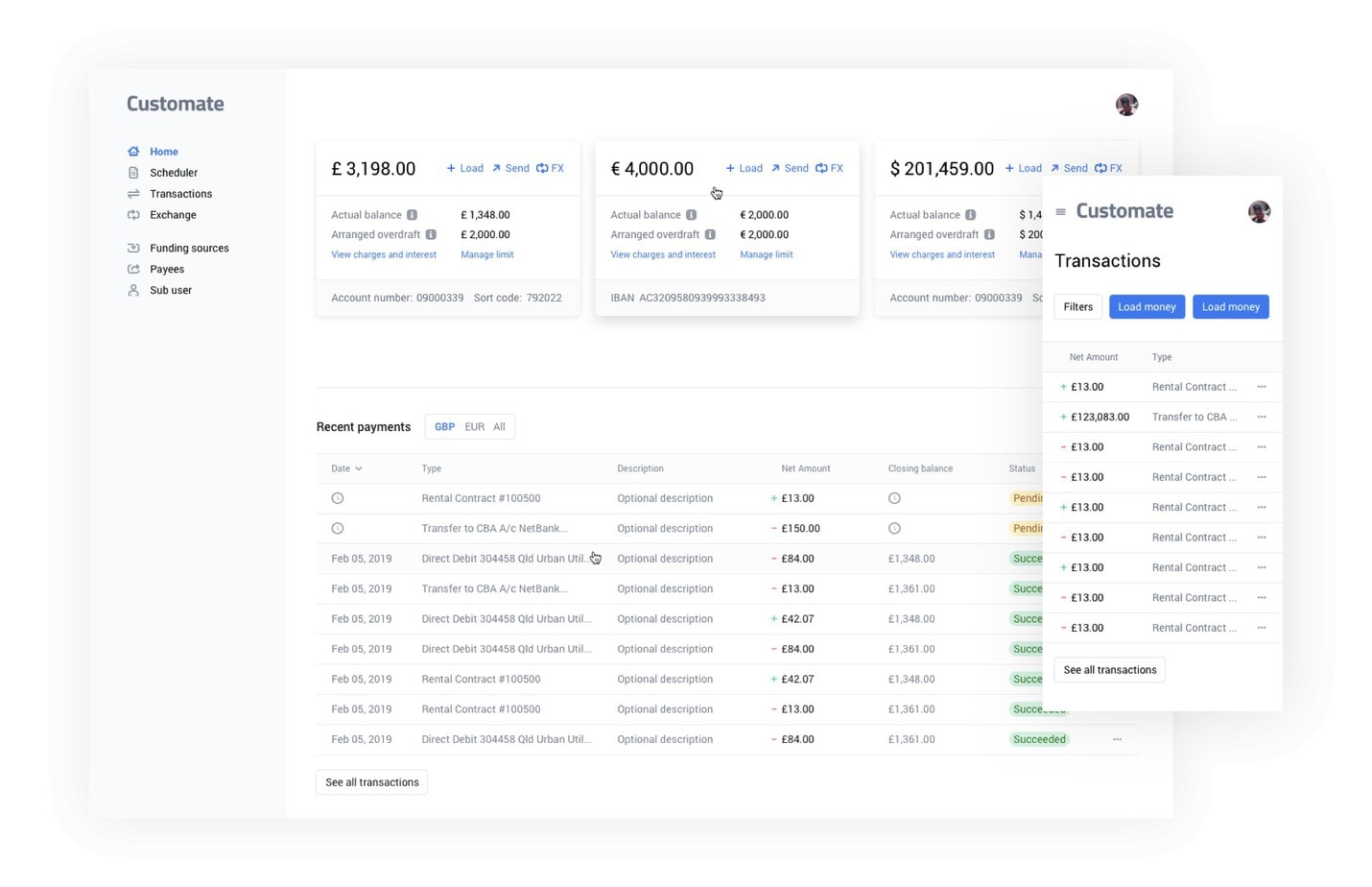

Unique Wallets For Each Customer

Customate’s Dedicated Customer Wallets provide you and your customers with your own unique bank account for multiple currencies. This allows your customers to make payments into dedicated bank accounts and remove any reconciliation issues. Establish Automated Funding Schedules to make recurring Payments to your suppliers and Collections from these Virtual Bank Accounts.

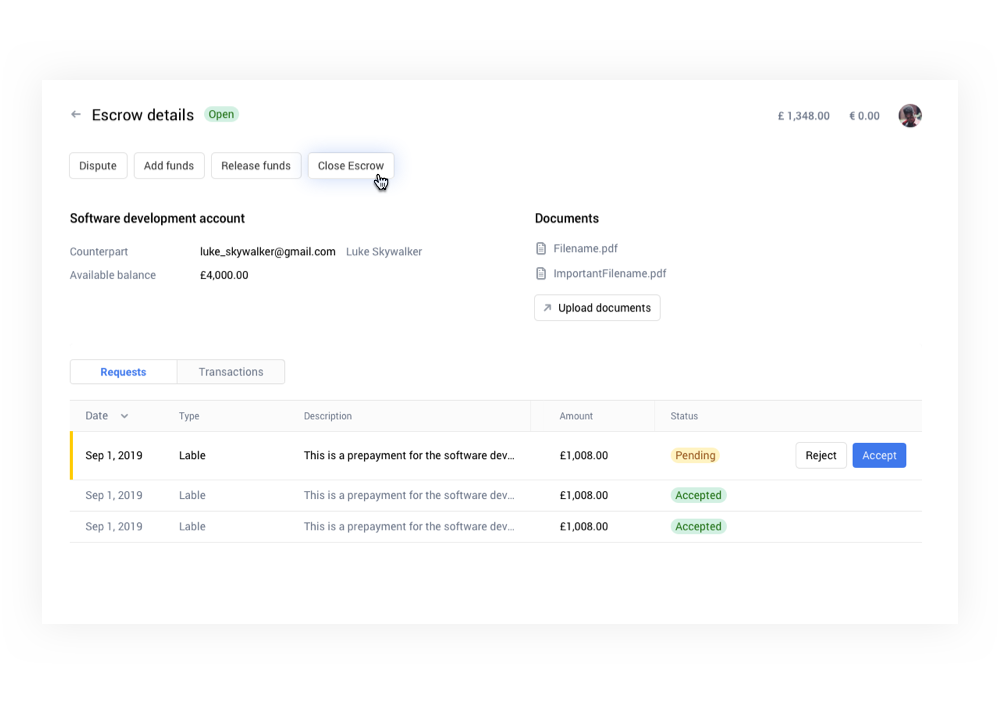

create multiple escrow wallets to protect funds against fraud

Your payment flow may benefit from Digital Escrow Wallets. The escrow wallets enable you to hold funds in escrow pending the achievement of your own customised milestones. The escrow wallet is initially funded by the buyer and only once both parties agree that a milestone has been acheived, funds are released from the escrow wallet to the sellers wallet.

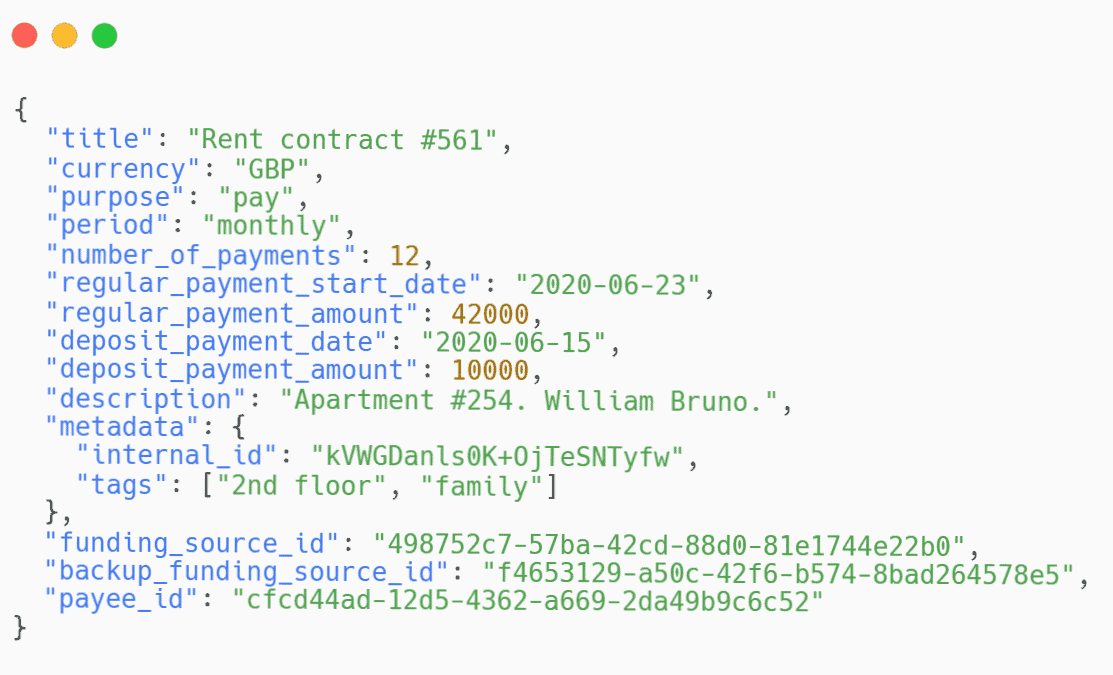

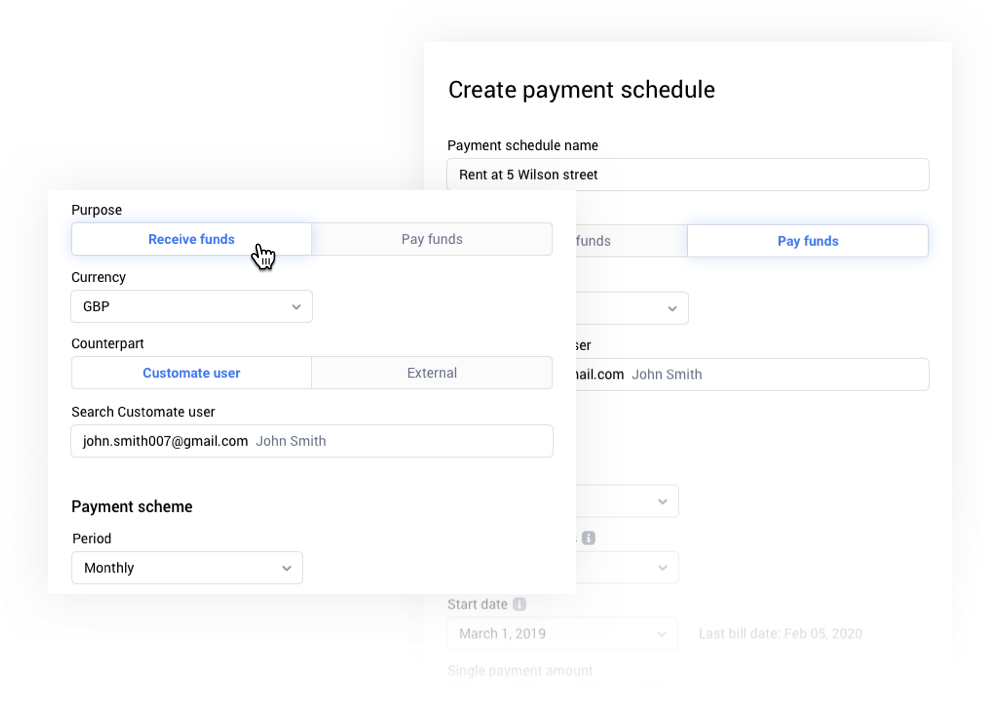

Create automated payment schedules for receipts and payments

Use the “Scheduler” to establish one-time or recurring schedules. Invite your customers to pay you, or make payments to them. No more late collections or forgotten payments, just set and forget. Payments are automatically reconciled as your customers are assigned a their own Digital Wallet with unique bank accounts. Upload contracts or files as supporting documentation.

Accept Direct Debits, Open Banking, Bank transfers, Cards

All members are assigned unique Digital Wallets which include bank accounts in GBP, EURO and USD. These Digital Wallets can be funded via bank transfer, open banking, card payment or direct debit. All funds are safeguarded in a ring-fenced bank account. This flexibility allows you to attract more customers, improve cashflow and automate the process of paying and receiving funds.

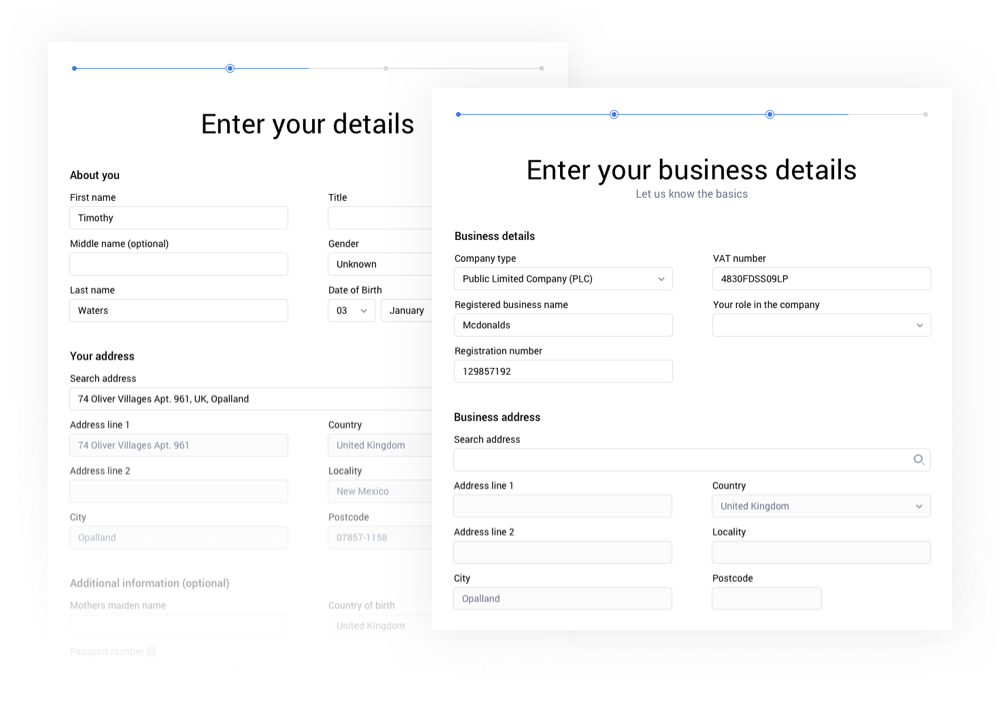

Digital customer on-boarding and verification

Registering is done digitally and in real-time. No software installations or paperwork. We verify organisations and the beneficial owners of the business. This makes the process faster and simpler for yourself and your customers and provides the peace of mind that your counterpart is independently verified.

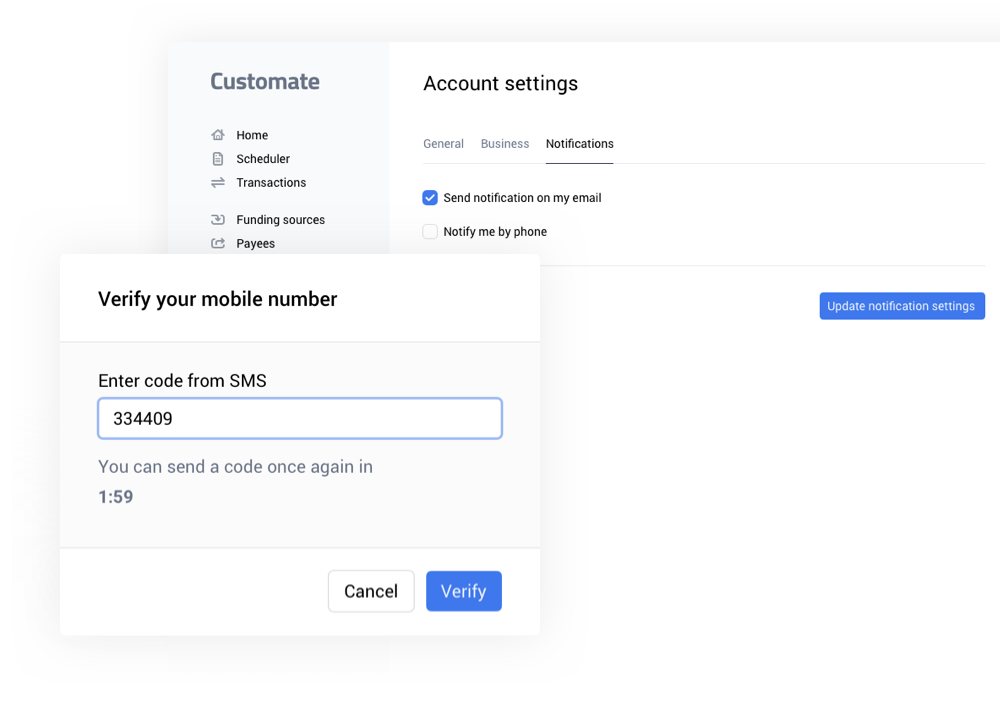

Reconcile your payments with web hook notifications

Access to your account is managed by multiple factors of authentication. You will have real-time transaction reporting and visibility of all transactions. Users can edit pending transactions and schedules in real time.

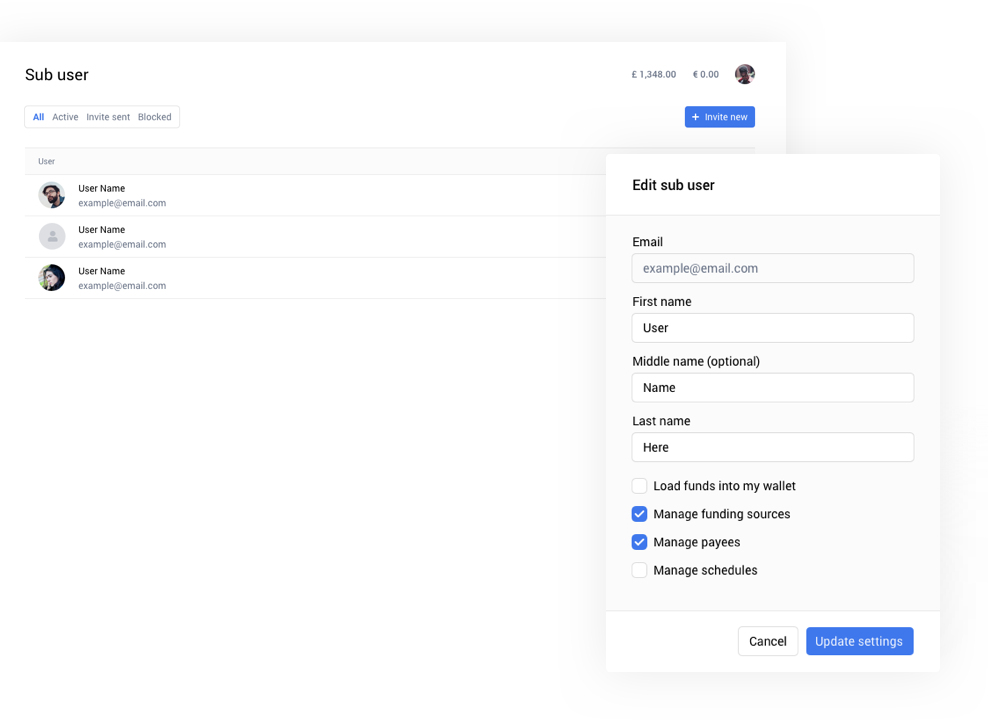

Assign roles and white-list funding sources and Payee accounts

Master users can assign roles to members within their organisation to add multiple levels of oversight. This can include white-listing only trusted bank accounts to accept money from or to pay money to, limits and frequency controls to suppliers and enforcing company policies around payments.